Consistent with other IFRS impairment guidance IFRS 15 requires impairment losses to be reversed in certain circumstances similar to the. Trade receivables arising from the sales of copper gold and silver concentrate with provisional pricing features are exposed to future movements in market prices as described below and therefore contain an embedded derivative.

Ias 36 Impairment Of Assets Disclosure Ifrscommunity Com

Consistent with other US GAAP impairment guidance ASC 340-40 Other Assets and Deferred CostsContracts with Customers does not permit entities to reverse impairment losses recognized on contract costs.

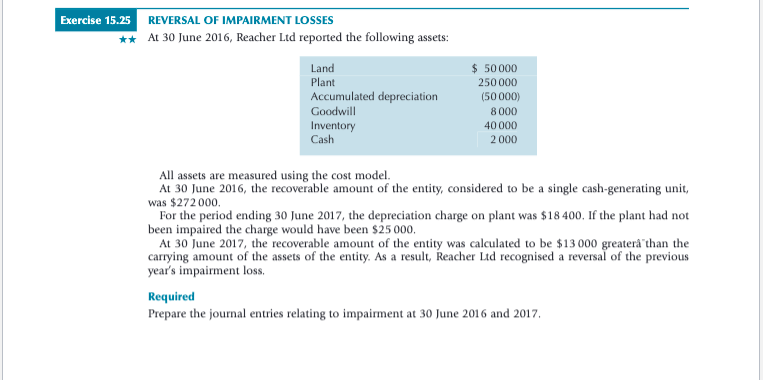

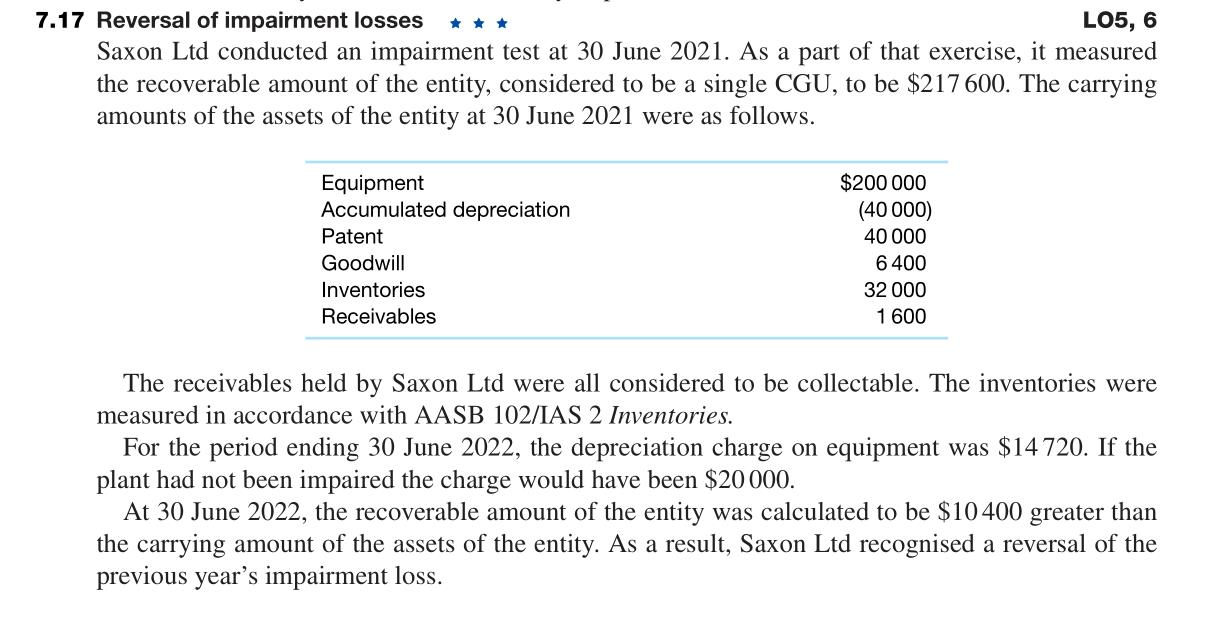

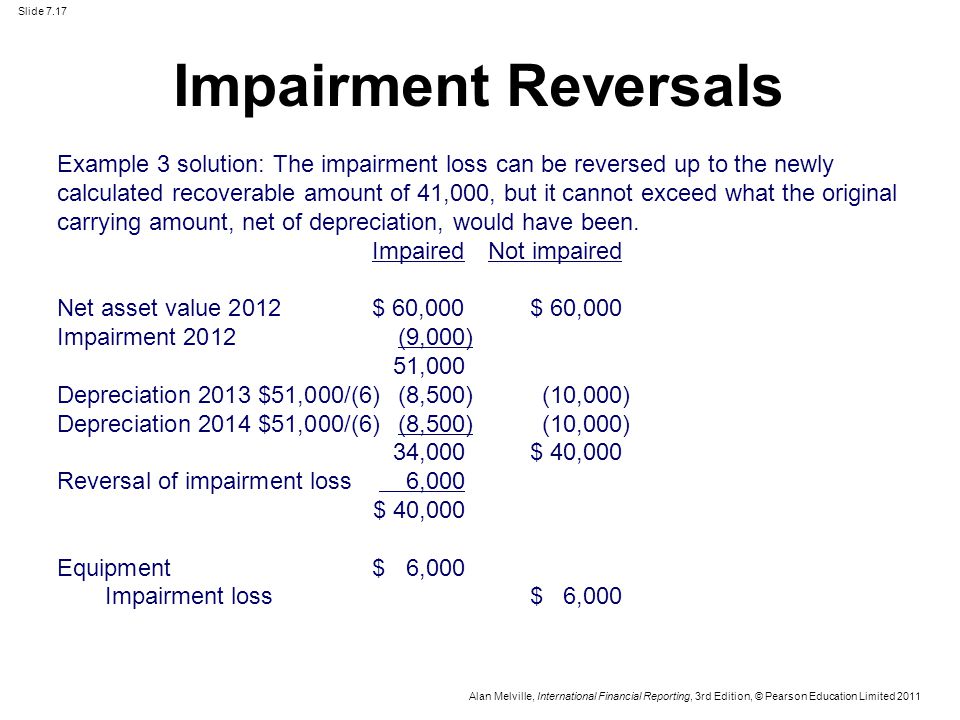

. On reversal the assets carrying amount is increased but not above the amount that it would have been. Without impairment 400 depreciated for 4 years at 10 straight line would have had a cv of 240 and thats the limit of our reversal. Recognise or reverse any impairment loss.

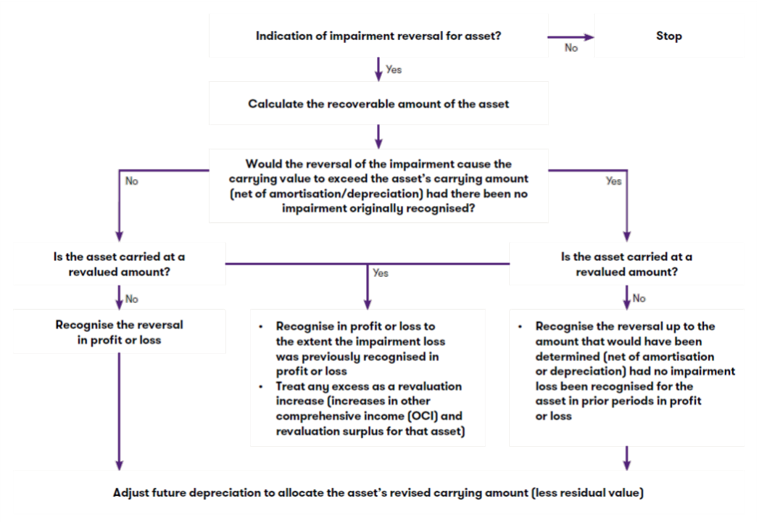

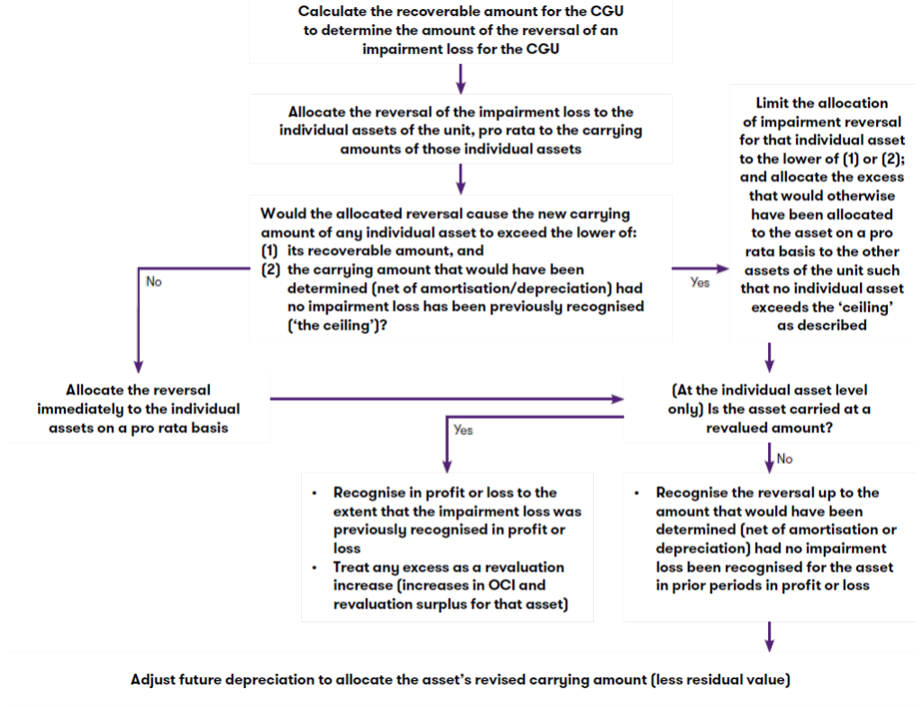

The requirements for recognising and measuring impairment losses differ based on the structure of the impairment testing as determined in Step 2 discussed in our article Insights into IAS 36 Scope and structure of an impairment review. The Standard also defines when an asset is impaired how to recognize an impairment loss when an entity should reverse this loss and what information related to impairment should be disclosed in the. Reversal of impairment losses of a disposal groups assets occurs when an asset held for sale is impaired but then revalues as follows.

An impairment reversal is only permitted if there has been a change to the estimates used in determining the original impairment loss. Rather any expected recoveries in future cash flows are reflected as a prospective yield adjustment. IAS 36121 Reversal of an impairment loss for goodwill is prohibited.

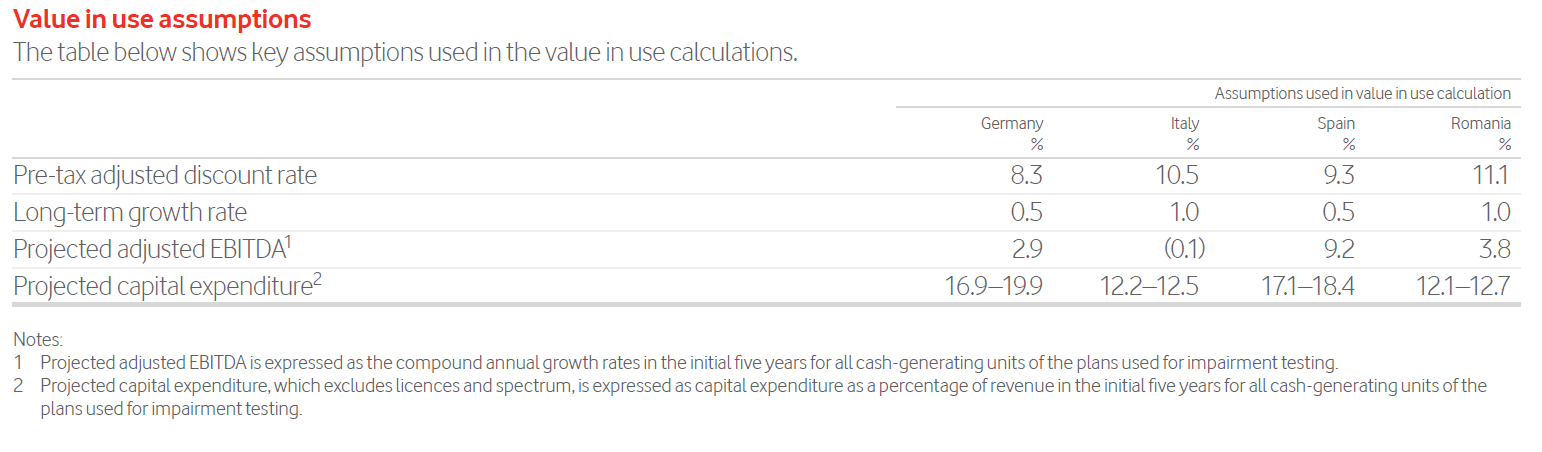

115 A reversal of an impairment loss reflects an increase in the estimated service potential of an asset either from use or from sale since the date when an entity last recognised an impairment loss for that asset. The recoverable amount of an asset or a CGU is the higher of its fair value less costs to sell and its value in use. IFRS permits the reversal of impairment for long-lived assets IAS 36.

Now your post asks about the reversal of a previous impairment lets say the reversal is for 900. In the first case we would. We simply undo the previous impairment entry.

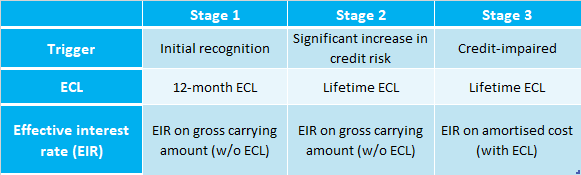

1After recognition of the impairment loss at the end of 20X4 T revised the depreciation charge for the Country A identifiable assets from Rs. The amount of ECL or reversal that is required to adjust the loss allowance at the reporting date to the amount. As mentioned the accumulated impairment loss is the contra asset account to reduce the assets value.

Reversal of an impairment loss is recognised in the profit or loss unless it relates to a revalued asset IAS 36119 Adjust depreciation for future periods. Disclosure by class of assets. And in the second case we.

Reversals of impairment losses for debt securities classified as available-for-sale or held-to-maturity securities are prohibited. Reversal of the impairment is. Triggers for reversing an impairment loss.

If a company records an impairment loss for a held-for-sale asset then under US. If the asset is held-for-use then the company is not allowed to recover or reverse the losses. This account holds all the impairment losses for assets over their life.

Dr Asset Account 900 Cr Profit or Loss Account 800 Cr Revaluation Reserve 100. Accumulated impairment losses land Dr 300000 Reversal of impairment loss Cr. Overall companies can record impairment loss journal entries as follows.

Dr Profit or Loss Account 2000 Cr Asset Account 2000. For other assets when the circumstances that caused the impairment loss are favourably resolved the impairment loss is reversed immediately in profit or loss or in comprehensive income if the asset is revalued under IAS 16 or IAS 38. This is recorded as a loss of 4500 in the income statement.

The loss allowance is calculated in accordance with the impairment of financial assets policy described below. The reversal of the impairment loss is recognised to the extent that it increases the carrying amount of the tangible non-current assets to what it would have been had the impairment not taken place ie a reversal of the impairment loss of 10m is recognised and the tangible non-current assets written back to 70m. In general asset impairment indicates that an asset costs more to a business than it is worth.

There are times however when this situation changes and the asset becomes valuable. However impairments cannot be reversed in ASPE ASPE 3063 accounting standards. IAS 36 Impairment of Assets applies to a variety of non-financial assets including property plant and equipment PPE right-of-use assets intangible assets and goodwill investment properties carried at cost and investments in associates and joint ventures 1.

Paragraph 130 requires an entity to identify the change in estimates that causes the increase in estimated service potential. Reversal of impairment is a situation where a company can declare an asset to be valuable where it has previously been declared a liability. An impairment loss is the amount by which the carrying amount of an asset or cash-generating unit CGU exceeds its recoverable amount.

The requirements for recognising and measuring. The objective of IAS 36 Impairment of assets is to make sure that entitys assets are carried at no more than their recoverable amount. IAS 362 4 If these assets other than goodwill have been.

On top of that the presentation and disclosures also vary. Accounting entry to record the bad debt will be. IAS 36 also outlines the situations in which a company can reverse an impairment loss.

1237 lakhs per year based on the revised carrying amount and remaining useful life 11 years. GAAP the company is allowed to subsequently restore the value of the asset back to the carrying amount prior to the impairment. The technical definition of the impairment loss is a decrease in net carrying value the acquisition cost minus depreciation of an asset that.

The indicators used to determin. The impairment loss should be reversed but only to the extent that it does not exceed the carrying amount that would have been determined had no impairment loss been recognised in prior years AASB 136 para 117 hence reverse the prior impairment loss of 300000. Fair value less costs to sell of assets held for sale may exceed the assets carrying amounts either at the initial classification date or on subsequent remeasurement under IFRS 5.

There has been a favourable change in the estimates used to determine. 1333 lakhs per year to Rs.

Solved Exercise 15 25 Reversal Of Impairment Losses At 30 Chegg Com

Accounting For Property Plant And Equipment Reversal Of Impairment Loss Part 1 Youtube

I Have Created 20 Example Audiograms On Speech Bananas Along With A Reading The Audiogram Worksheet That The Student Will Complet Teachers Speech Hearing Loss

Solved 7 17 Reversal Of Impairment Losses Lo5 6 Saxon Chegg Com

What Do You Have To Lose A Display Of The Effects On Daily Living Resulting From Mild Moderate And Severe He Speech And Hearing Hearing Health Hearing Loss

Understanding Low Frequency Hearing Loss Reverse Slope Hearing Loss Hearing Loss

Solved 7 18 Cgus Reversal Of Impairment Losses 05 6 The Chegg Com

Ifrs Ias 36 Reversing Impairment Losses Grant Thornton Insights

Accounting For Impairments Of Ppe Youtube

Chapter 7 Impairment Of Assets Ias36 Ppt Video Online Download

Memory Loss Causes Improve Memory With Memory Supplements Aging Well Mthfr Memory Supplements

Ifrs Ias 36 Reversing Impairment Losses Grant Thornton Insights

Ifrs Ias 36 Reversing Impairment Losses Grant Thornton Insights

Impairment Of Financial Assets Ifrs 9 Ifrscommunity Com

Reversal Of Impairment Losses Annual Reporting

May Is Better Hearing And Speech Month It S Time To Start Considering The Damage Many Activities Speech And Hearing Audiology Student Auditory Verbal Therapy